Investment Opportunities

Assisted Living

Assisted Living Outlook

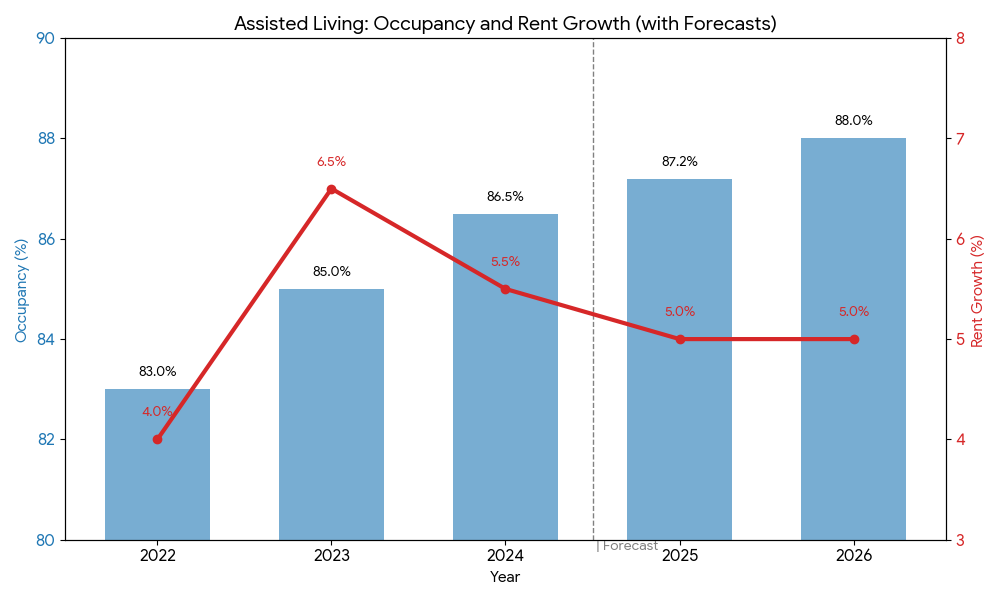

Figure 1: Assisted Living occupancy (bar) and rent growth (line) by year, with forecasts. Assisted Living occupancy reached 87.2% in Q3 2025 and is on an upward trajectory. Rent growth is expected to stabilize at a strong rate of 3–7%.

Resilient Fundamentals: The Demographic Powerhouse

The Assisted Living (AL) sector is experiencing a surge in demand driven by the aging Baby Boomer generation, who are now moving into their late 70s and 80s. Despite past challenges, the current environment shows significant strengthening. National senior housing occupancy reached 88.7% in Q3 2025, with Assisted Living specifically climbing to 87.2%, marking its 17th consecutive quarterly increase, according to NIC MAP data. This record-low vacancy is supported by a very tight supply pipeline, with new inventory growth hitting a low in 2025. This combination of rising demand and limited new construction due to high costs and capital constraints supports projected rent growth of 3–7% for the senior housing sector over the next 12 months. CMIC analysis confirms that well-located, modernized AL facilities are a highly coveted asset class.

Consumer Spending and Shifting Preferences

Demand is not only driven by volume but by consumer expectations for quality and lifestyle. The new cohort of seniors, who hold a significant portion of U.S. household wealth, prioritizes autonomy, wellness, and social engagement. This is translating into an increased demand for personalized, hospitality-focused services and modern amenities, such as gourmet dining and fitness centers. The majority of AL is funded via private pay (personal finances, long-term care insurance), which has historically kept rental rates resilient to economic fluctuations. This preference shift, coupled with the need for specialized care, implies that high-quality, amenity-rich assets will continue to generate stable, predictable cash flows, making them an attractive asset for CMIC members seeking reliable income.

Spotlight on Segments: Modernization and Value-Add

Within the broader senior housing sector, Assisted Living and Memory Care stand out for their strong growth potential due to the increasing need for high-acuity, specialized care. Traditional, older facilities may struggle to compete. Our investment criteria favor assets with a modernized physical plant and a strong operational platform capable of delivering high-quality care. We see significant opportunity in value-add repositioning—acquiring and upgrading older properties to meet contemporary consumer expectations. This hands-on underwriting, focusing on operational excellence and a path to higher-end rent, is critical for capturing the maximum return from the sector’s demographic tailwinds.

Outlook: Stable Returns and Portfolio Resilience

Overall, Assisted Living offers a strong counter-cyclical investment opportunity due to its non-discretionary, needs-based demand. Rising occupancy and robust rental growth mean that operating income is expected to outpace inflation. For CMIC, an allocation to Assisted Living can enhance portfolio resilience by diversifying risk away from traditional commercial real estate cycles. We will prioritize assets in markets with accelerating population growth and wealth—such as Sun Belt metros (e.g., Phoenix and Miami)—and those with demonstrable operational strength. By focusing on quality of care, occupancy momentum, and value-add potential, we expect Assisted Living real estate to deliver consistent, risk-adjusted returns in 2025 and beyond.

Assisted Living Investment Opportunities

ASSITED LIVING/RAL

DFW, 5 properties