Investment Opportunities

Mobile Homes

Mobile Homes Outlook

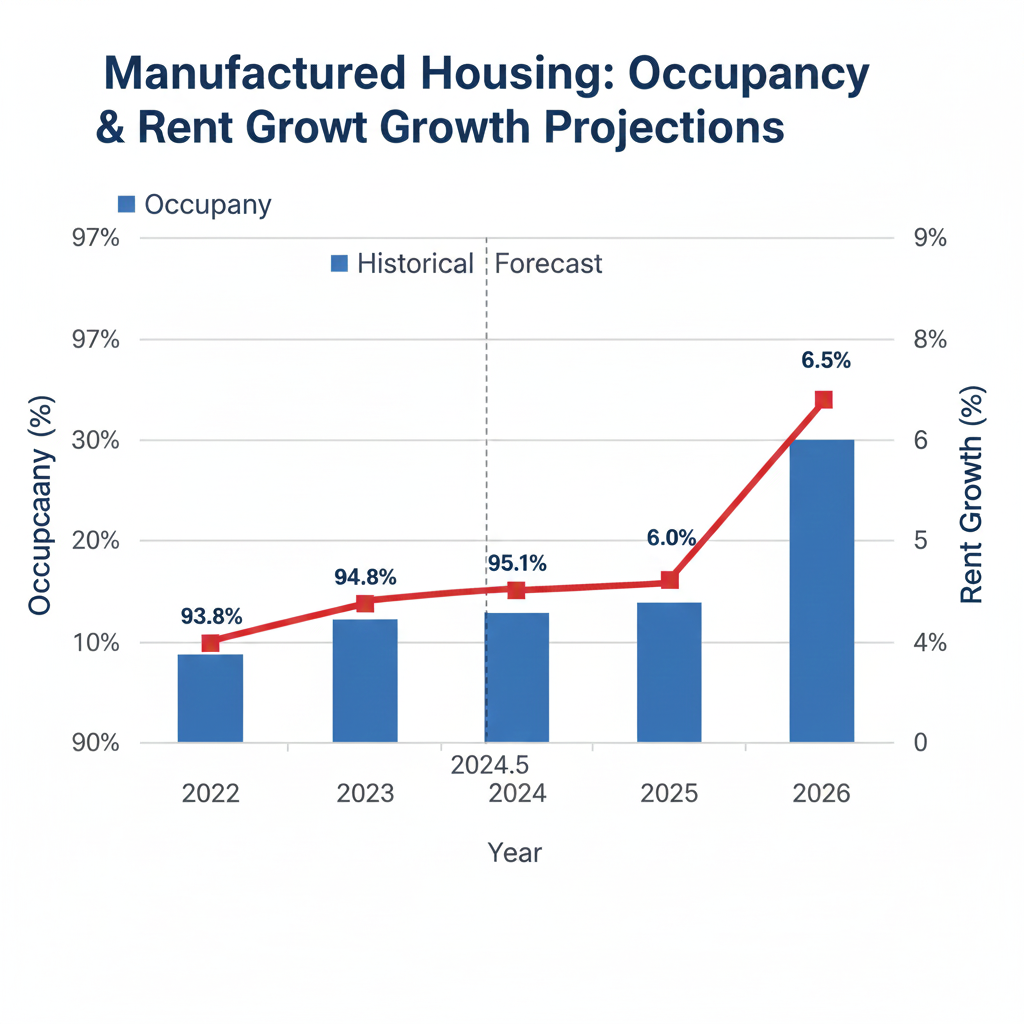

Figure 7: Mobile Home occupancy (bar) and rent growth (line) by year, with forecasts. Occupancy remains exceptionally high (~94–95%) while rent growth is projected to remain robust at 5–7%, significantly outperforming traditional multifamily.

Resilient Fundamentals: Scarcity Drives Value

The Manufactured Housing (MH) sector, often referred to as mobile home parks, enters 2025 as one of the most stable and defensive asset classes in real estate. Despite a shifting economy, overall demand for affordable housing has kept national vacancy at a record-low ~5.2%, with institutional-grade portfolios reporting even tighter figures near 97%. The “moat” around this sector is arguably the strongest in real estate: new development is almost non-existent due to restrictive zoning and high land costs. CMIC analysis indicates that this permanent supply constraint, coupled with high resident “stickiness” (the cost to move a home often exceeds $10,000), provides owners with immense pricing power and protection against market volatility.

Affordability Drivers: The Non-Discretionary Necessity

Consumer demand is bolstered by a persistent housing affordability crisis. With traditional home prices and mortgage rates remaining elevated, MH continues to be the only viable path to homeownership for millions. This trend is no longer confined to low-income brackets; we are seeing a broader demographic shift including retirees downsizing for lifestyle and remote workers seeking lower cost of living. Importantly, lot rent remains a fraction of traditional apartment rents—often 30–50% lower—which leaves significant “headroom” for consistent rent increases. For CMIC members, this translates into a highly reliable income stream that is remarkably decoupled from the broader retail or office cycles.

Spotlight on Segments: 55+ Communities and Sun Belt Strength

Performance within the MH sector is particularly strong in Age-Restricted (55+) communities and properties located in the Sun Belt (e.g., Florida and Arizona). These assets benefit from the “silver tsunami” of aging Baby Boomers who prioritize safety and community amenities. Our investment criteria favor “all-age” communities in high-growth metros where the delta between lot rent and apartment rent is greatest. We also see opportunity in utility sub-metering and operational professionalization of family-owned parks. We emphasize thorough environmental and infrastructure due diligence to ensure that passive investors are protected from the capital expenditure risks associated with aging underground utilities.

Outlook: A High-Yield Inflation Hedge

Overall, manufactured housing offers some of the most consistent risk-adjusted returns in the real estate market for 2025. Because demand is needs-based rather than discretionary, occupancy remains stable even during downturns. With rents projected to grow 5–7%, the sector serves as an excellent hedge against inflation. For CMIC, MH allocations provide a “recession-resistant” anchor to a diversified portfolio. We will continue to prioritize high-barrier-to-entry markets and parks with a high percentage of homeownership, which reduces turnover and maintenance costs. By focusing on supply scarcity and affordability, we expect manufactured housing to deliver superior yield and capital appreciation throughout the coming year.

Mobile Homes Investment Opportunities

Two Pack RV Park

Ada, OK