Investment Opportunities

Retail -NNN

Retail Outlook

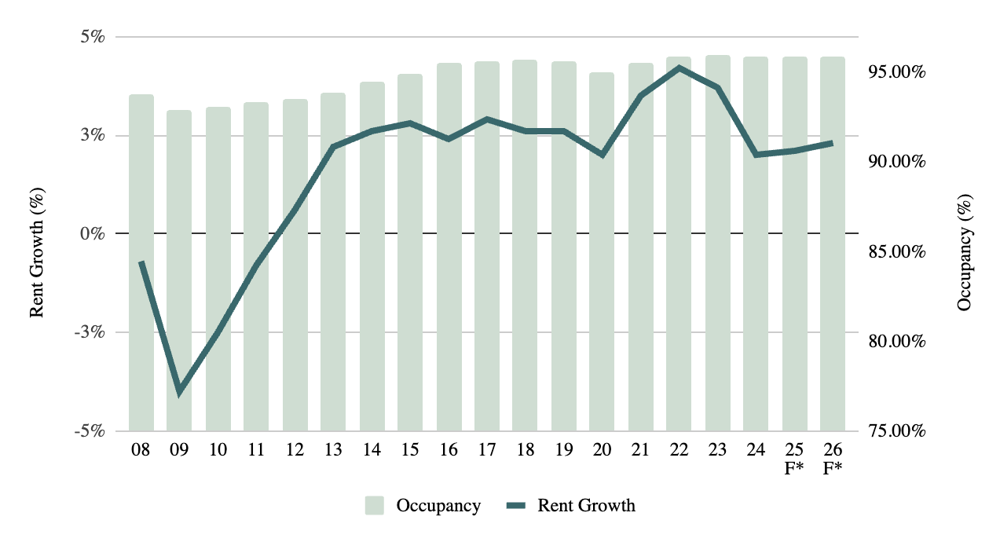

Figure 1: Retail occupancy (bar) and rent growth (line) by year, with forecasts. Occupancy remains very high (~92–93%) and rent growth has stabilized around 2–3%.

Resilient fundamentals: The retail sector is surprisingly strong in 2025. Despite years of store closings, overall demand has kept vacancy at a record-low ~4.1%. Many big-box and shopping-center tenants have exited, but essential retailers (grocery, discount, home improvement, pharmacies) have expanded or relocated into modern formats. CMIC analysis confirms that well-located grocery-anchored centers and dominant mall properties are in high demand. We note that retail availability is scarce nationally (only ~0.4% of stock under construction), which supports rent growth and asset values.

Consumer spending: U.S. retail sales are forecast to rise ~2.7–3.7% in 2025, in line with pre-pandemic trends. Consumer spending is bolstered by strong labor markets and wage growth. Importantly, foot traffic and shopping activity are rebounding: CBRE projects that prime retail districts will exceed 2019 visitor levels by 2025. This trend implies that brick-and-mortar shopping remains a vital part of consumer life, especially for food and services. CMIC members should view this as a positive sign that well-tenant retail assets will continue generating steady income.

Spotlight on segments: Within retail, performance varies widely. Grocery-anchored and necessity-based centers perform best, while tertiary malls and big-box retail in weak demographics struggle. Our investment criteria favor omnichannel-protected formats. We also see opportunity in adaptive reuse of old retail spaces (e.g. converting vacancies into fulfillment or service uses). We emphasize hands-on underwriting – strong tenant mixes and pro forma stress tests – to ensure passive investors capture the rising cash flows without undue risk.

Outlook: Overall, retail offers stable cash yields and a hedge against consumer trends. Rising occupancy and moderate rent growth mean rents should keep pace with inflation. For CMIC, retail allocations can enhance portfolio resilience. We will prioritize markets with growing populations and income – for example, Sun Belt metros – and assets with long-term leases to blue-chip tenants. By focusing on cash-flow reliability and low vacancy, we expect retail to deliver consistent, risk-adjusted returns in 2025.

Land Development Investment Opportunities

HARRIS RIDGE

Austin, TX

BerryCreek Business Park

Georgetown, TX